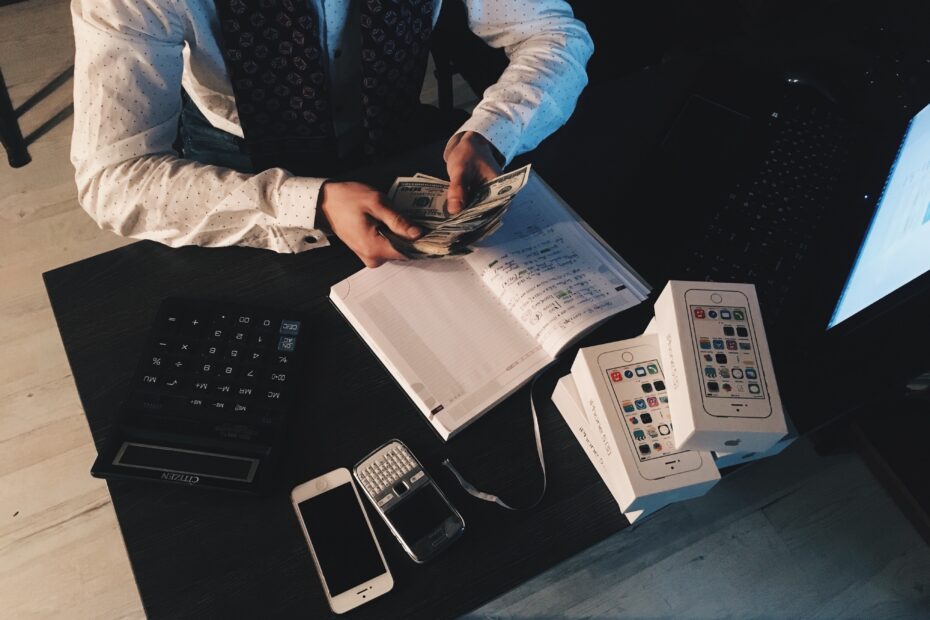

The Best Bad Credit Business Funding Options

Your business needs to hire a few more employees and purchase new equipment, but you have run into an obstacle. You need to boost your cash-flow to do so, but do not have the credit score you need to qualify… Read More »The Best Bad Credit Business Funding Options