Not Forgotten: Covid-19 Relief Loan For Contractors

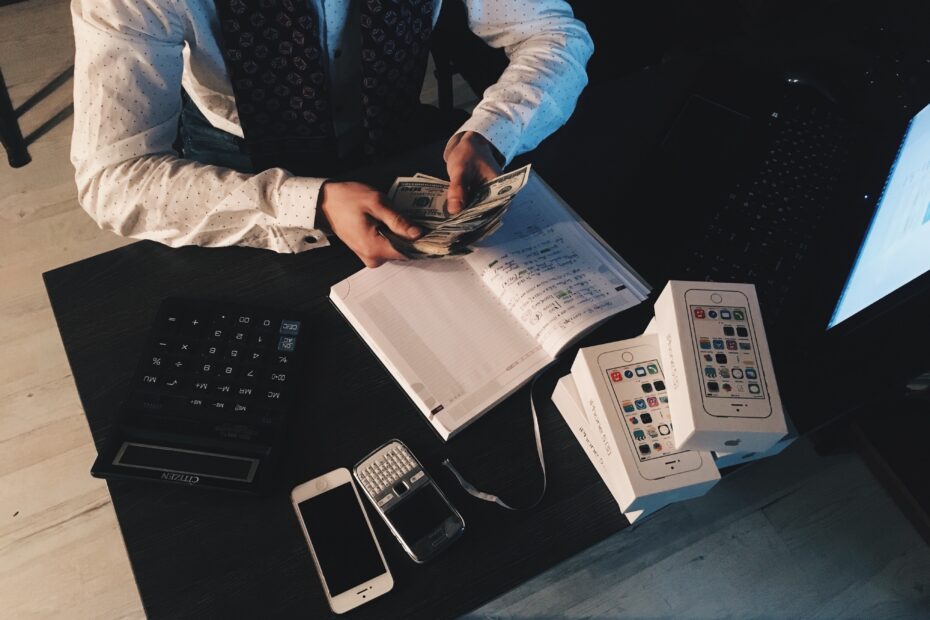

Covid-19 relief loans for contractors are a welcomed help for many without financial buffers. An unprecedented number of American workers have been laid off or lost their employment outright, due to the Covid-19 pandemic. Another hard-hit sector of workers that… Read More »Not Forgotten: Covid-19 Relief Loan For Contractors