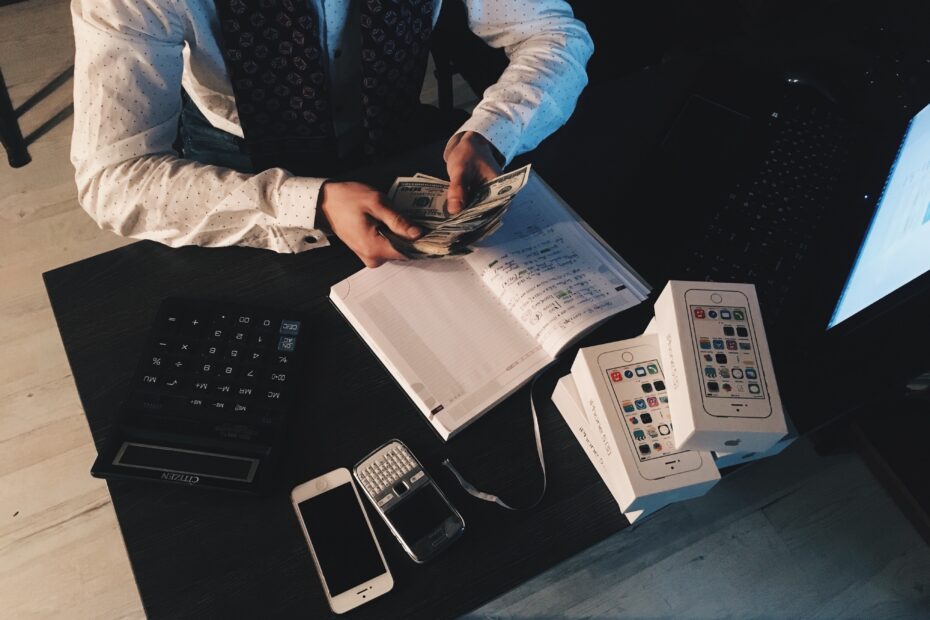

Small Business Funding Methods To Consider

Alternative lending options provide business owners with a myriad of funding options. However, small businesses may sometimes find it challenging to get approved for a business loan because of risks associated with their newborn company. If you’re concerned with getting… Read More »Small Business Funding Methods To Consider