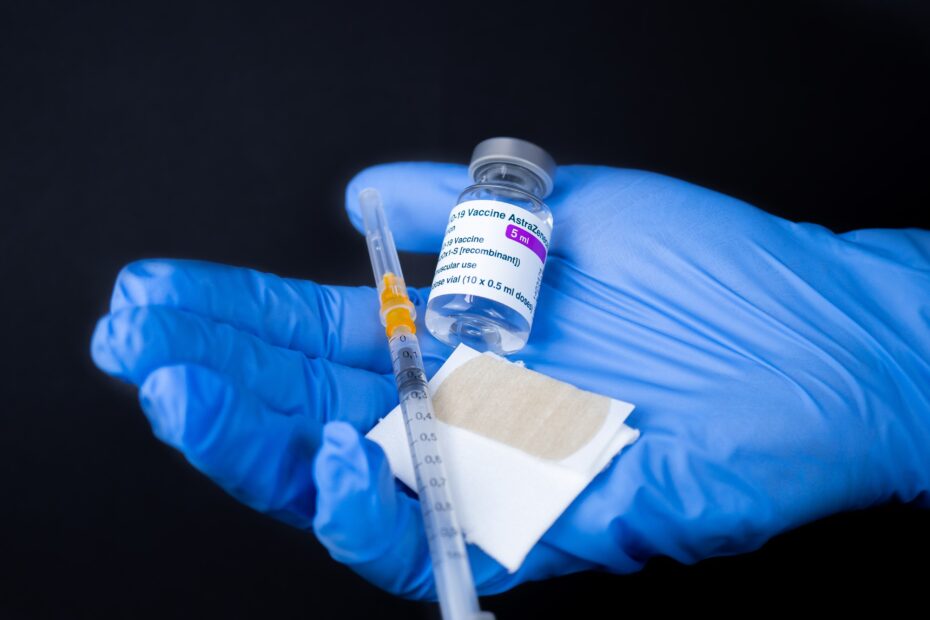

Can I Ask Employees About Their COVID-19 Vaccination Status?

One of the biggest challenges for employers regarding COVID-19 is keeping track of which employees have been vaccinated. Asking workers about their COVID-19 vaccination status is a smart thing to do. It’s also something that you probably don’t feel comfortable… Read More »Can I Ask Employees About Their COVID-19 Vaccination Status?