Build Your Company

If you’re an entrepreneur in the development and contracting industry, and have applied for loans through conventional banks, you’ve likely experiencing the insurmountable requirements, the arduous, long process of getting approved, and the frequent declines as banks become more and more conservative about who they’re lending to. Banks reject upwards of 60% of small business loans. To make matters worse, decline rates are higher for contractors and developers, due to the nature of the industry and its higher risk factors for failure.

Trouble Deciding? Email Our Sales Team for more info!How much capital do you need?

Get approved for up to $100,000. Need more? Our experienced staff can help. $2500$100,000Already Trusted by Thousands of Owners

First American Merchant is already a trusted funding source for countless business owners. The majority of our merchants return to us again, and again when their business require capital. Whether your company is large, or small, we have the funding options you need to grow your business.

Post boom the landscape for contractors has changed dramatically. Banks are now looking for larger equity investments from builders and developers, and creating terms that prevent contractors from abandoning deals. This makes it more financially burdensome for contractors to take on new, and varying projects, and puts the pressure on the business owner to be more thoroughly invested into the project’s success, something that is often out of their hands.

Although there are still volume opportunities, and banks are easing their loan pricing, the pre-boom golden age era of “build it and they will come” is now a thing of the past. FAM can help contractors, developers, and even freelance subcontractors assisting larger builders, by offering them the ability to improve their equity position with the banks, fund resources for projects, hire new help, or buy new equipment. All with great repayment terms and fast lending.

The First American Merchant Difference

Traditional Lenders

- Strict Document Requirements

- Long Application Process

- Decisions Can Take Weeks

- Outsourced Customer Service

- Limited Funding Requirements

- Credit-based Approvals

- Minimal Documentation Needed*

- Application Takes Minutes

- Same or Next Day Approvals

- In-house Customer Service

- Multiple Funding Options Available

- Decisions Based on Income

Funding That Works For You

First American Merchant Funding is the perfect partner for your business. We have a quick application process, we fund fast, and we have the capacity to assist funding even the largest businesses. Need a few hundred thousand dollars to get your business moving in the right direction? We’re happy to help.

We have some of the best repayment rates in the industry. What are you waiting for? Get started now and watch your business grow!

Fill Out Our ApplicationWorking Capital

We provide the entrepreneur alternative ways to gain access to working capital. Our flexible and affordable repayment options are designed to minimize the burden on your pocket!

Easy Approvals

Unlike a bank, we have fewer requirements for funding approval and we don’t base our decision on your credit rating. Contact us today to see how First American Merchant Funding can work for you!

Large-scale Funding

Your business is an expensive venture, imagine the peace of mind you’ll have with up to $1 million in unsecured capital available and ready for all of your financial challenges.

We Can Help You Move Your Business Forward

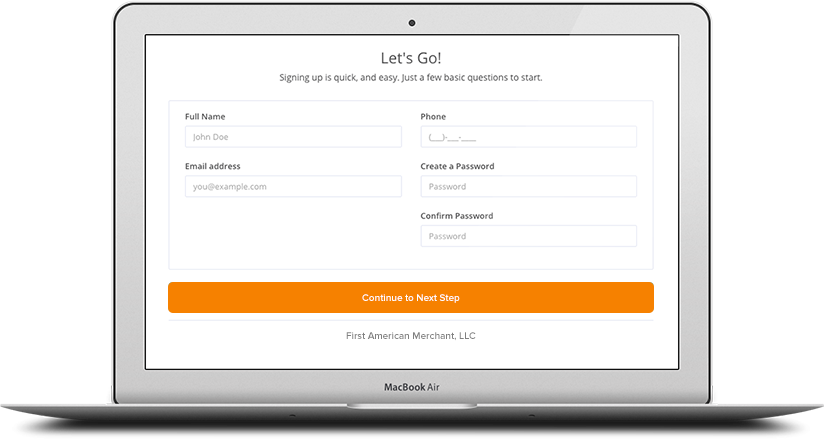

Our Application Process is Quick and Easy

In just a few short steps, we’ll have everything we need

and you’ll be on your way to accepting payments